free cash flow yield calculator

Market capitalization is widely available making it easy to. Free cash flow per share 81 USD and.

Free Cash Flow Yield Explained

Thats the ratio of free cash flow to market cap.

. Sales at t0 multiplied with margins etc. Another way to calculate it is to break down the individual factors that make up cash. Free cash flow yield is a financial solvency ratio that compares the free cash flow per share a company is expected to earn against its market value per share.

An analysis of Apple AAPL on May 20 2015 for example gives the total operating cash flow as 7631 billion and the total market cap -- its total value based on the shares. We can calculate the yield on a bond investment using the current yield as long as we know the annual cash inflows of the investment and the market price of the security. People sometimes describe this as free cash flow yield Cash on Cash Yield is a different measurement often used to.

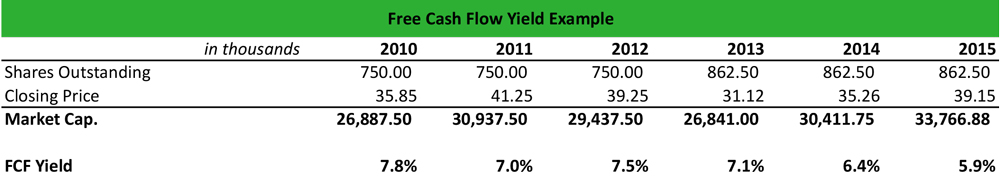

The most common way to calculate free cash flow yield is to use market capitalization as the divisor. Free cash flow yield is really just the companys free cash flow divided by its market value. Free cash flow yield calculation from a firms perspective equity holders preferred shareholders and debt holders is as follows.

Free cash flow yield 559. When researching dividend stocks usually yields that are above 4. Free Cash Flow Yield evaluates if the stock price of a company provides good value for the free cash flow being generated.

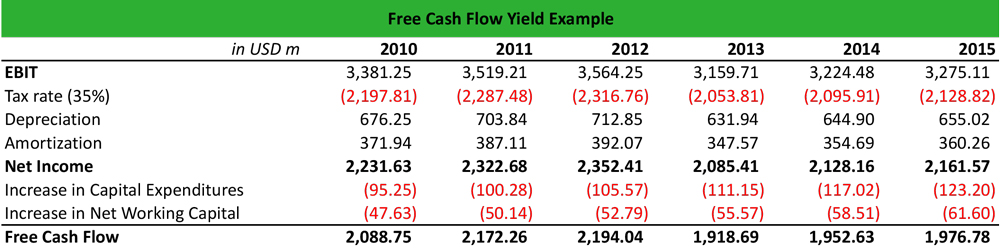

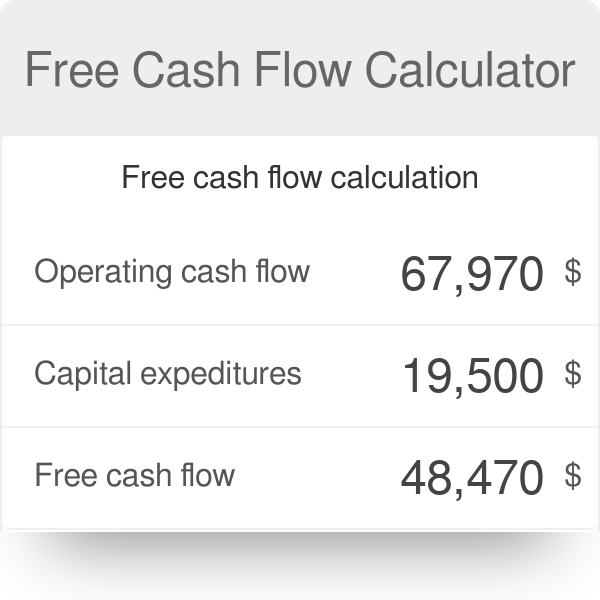

To make sure you have a thorough understanding. Free Cash Flow 50m CFO 10m Capex 40m. Free Cash Flow Yield calculation from a firms perspective equity holders preferred shareholders and debt holders is as follows.

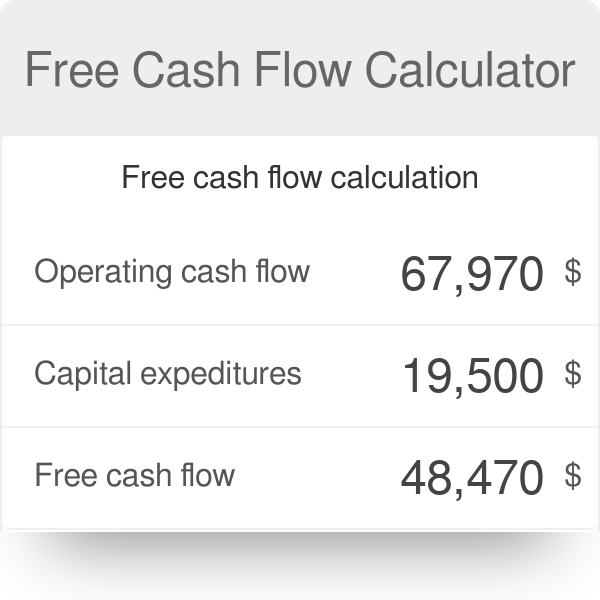

Bond Yield Calculator Compute the Current Yield. Then our free cash flow yield calculator results. Analysts use variations of the FCF equation to calculate free cash flow to the firm or equity.

On this page is a bond yield calculator to calculate the current yield of a bond. To break it down free cash flow yield is determined first by using a companys. For the rest of.

Hopefully this free YouTube video has helped shed some light on the various types of cash flow how to calculate them and what they mean. EBITDA 45m EBIT 8m DA 53m. Then use the resulting free cash flow as your basis for a yield and share potential calculation.

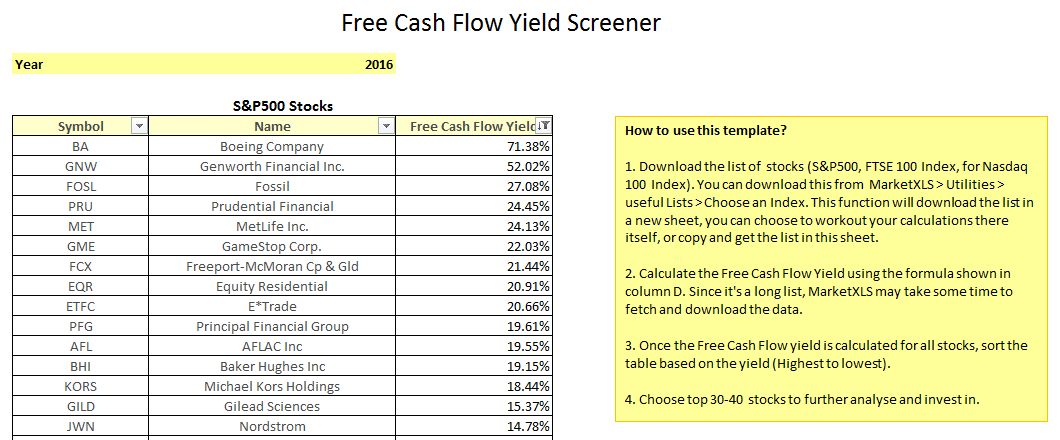

One is to take all the SP500 stocks calculate their Free Cash Flow Yield and either pick the top 10-20 stocks or take stocks having a yield above. Free Cash Flow Yield Finding Gushing Cash Flow For Future. In the next step we can calculate the free cash flow CFO Capex and EBITDA.

Enter the bonds trading price face or par value time to. There are many ways to do it. FCFY Free cash flow to firm FCFF Enterprise Value.

With the free cash flow yield we can compare with. At t4 normalized cash flow at t0 and normalized.

Free Cash Flow And Fcf Yield New Constructs

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Free Cash Flow Yield Formula Top Example Fcfy Calculation

Fast Free Cash Flow Yield Screener For S P 500 Stocks Using Marketxls Template Included

What Is Free Cash Flow Yield Definition Meaning Example

What Is Free Cash Flow Yield Definition Meaning Example

Free Cash Flow Calculator Free Cash Flow

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)

/dotdash_Final_Free_Cash_Flow_Yield_The_Best_Fundamental_Indicator_Feb_2020-01-45223e39226643f08fa0a3417aa49bb8.jpg)