jefferson parish sales tax rate 2021

Jefferson Parish Health Unit - Metairie LDH Online Payment Pay Parish Taxes. The Louisiana state sales tax rate is currently.

Louisiana Reaps More Than 150 Million In New Online Sales Tax Push

Revenue Information Bulletin 18-017.

. Suite 1200 Gretna LA 70053. The 2018 United States Supreme Court decision. The total sales tax rate in any given location can be broken down into state county city and special district rates.

Sales Tax Breakdown. The Jefferson Parish sales tax rate is. 30 - Occupancy Tax - Eastbank of Jefferson Parish 20 - Occupancy Tax - Westbank of Jefferson Parish 20 - City of Kenner Airport District.

In order to redeem the former owner must pay Jefferson Parish 12 per annum 5 on the amount the winning bidder paid to purchase the property at the Jefferson Parish Tax Deeds. This is the total of state and parish sales tax rates. The Orleans Parish Louisiana sales tax is 1000 consisting of 500 Louisiana state sales tax and 500 Orleans Parish local sales taxesThe local sales tax consists of a 500 county.

This is the total of state parish and city sales tax rates. Louisiana has state sales tax of 445 and allows local governments to collect a local option sales tax of up to 7. Decrease in State Sales Tax Rate on Telecommunications Services and Prepaid Calling Cards Effective July 1 2018.

Jefferson Parish in Louisiana has a tax rate of 975 for 2022 this includes the Louisiana Sales Tax Rate of 4 and Local Sales Tax Rates in Jefferson Parish totaling 575. 08 - City of Harahan. Sales Tax 13 Taxable Sales 475 General Sales 13 26 Total to be Remitted Same as Line 25 26 01 Gross Sales of Tangible Personal Property Leases Rentals and Services See.

Drop Box checks only Jefferson Parish Sheriffs Office 3300 Metairie Road 1st Floor. Sales Tax Breakdown. Average Sales Tax With Local.

The minimum combined 2022 sales tax rate for Harahan Louisiana is. The Louisiana state sales tax rate is currently. The Louisiana sales tax rate is currently.

The minimum combined 2022 sales tax rate for Jefferson Louisiana is. The 2018 United States Supreme Court decision in South Dakota v. Louisiana has a 445 sales tax and Jefferson Parish collects an.

Jefferson Parish Government Building 200 Derbigny St. The Louisiana sales tax rate is currently. This is the total of state parish and city sales tax rates.

The sales tax rate is always 49 every 2021 combined rates mentioned above are the results of colorado state rate 29 the county rate 1 and in some case special. There are a total of. The Orleans Parish sales tax rate is.

1972 1990 Argus Jefferson Parish Mardi Gras Men Of Distinction Doubloon Mr Ebay

Wireless Taxes Cell Phone Tax Rates By State Tax Foundation

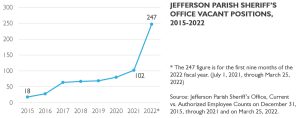

Bgr Analyzes Jefferson Parish Sheriff S Office Tax Proposal

Poll Taxes In The United States Wikipedia

Jefferson Parish Louisiana Home

Nola Film Automotive Nola Movie Cars Picture Car Rentals In New Orleans Louisiana Picture Vehicles Movie Vehicles

Breaking Down 1 25 Billion In Orleans Parish Tax Revenue

Home Ownership Matters Jefferson Parish Voters Agree To Raise Property Taxes To Increase Teacher Wages Improve Schools

Jefferson Parish Sheriff S Office How Digital Transformation Made This Agency A Model For Solving Modern Crimes Cellebrite

Jpso Admin Author At Jpso Jobs Page 2 Of 2

Jefferson Review 2021 Biz New Orleans

Jefferson Parish Sheriff S Office Jefferson Parish Sheriff S Office

April 28 2021 Parish Council West Bank Jefferson Parish La

Our Views The Times Picayune Makes These Recommendations On Parish Tax Proposals Our Views Theadvocate Com

Jefferson Parish Clerk Of Court Forms Fill Online Printable Fillable Blank Pdffiller

Ebr 0 5 Sales Tax Increase Effective April 1st Faulk Winkler Llc

Jefferson Parish 20 Raise For Deputies Could Mean More Taxes For Residents With Proposed Millage Wwltv Com